nevada estate tax rate 2021

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. Real Estate Tax Rate.

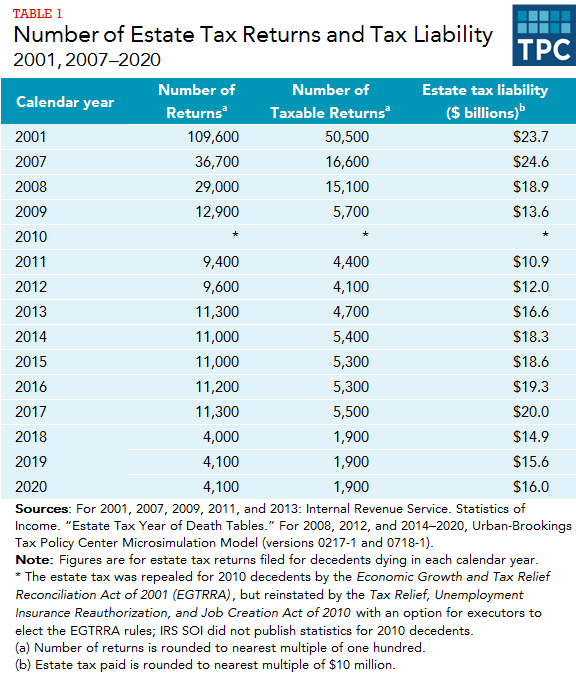

Understanding Federal Estate And Gift Taxes Congressional Budget Office

The property may be redeemed by payment of taxes and accruing taxes penalties and cost together with interest on the taxes at the rate of 10 percent per annum from the original date.

. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Compared to the 107 national average that rate is quite low. Property tax bills are mailed sometime in July of each year for both Real and Personal Property.

Here is a list of states in order of lowest ranking property tax to highest. The states average effective property tax rate is just 053. Homeowners in Nevada are protected from steep increases in.

District 902 - MESQUITE CITY REDEVELOPMENT. The exact property tax levied depends on the county in Nevada the property is located in. Click here to view the current tax district map.

STATE OF NEVADA. The property tax rates are proposed in April of each year based on the budgets prepared by the various local governments. Rates include state county and city taxes.

NRS 3614723 provides a partial abatement of taxes. Counties cities school districts special districts such as fire. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

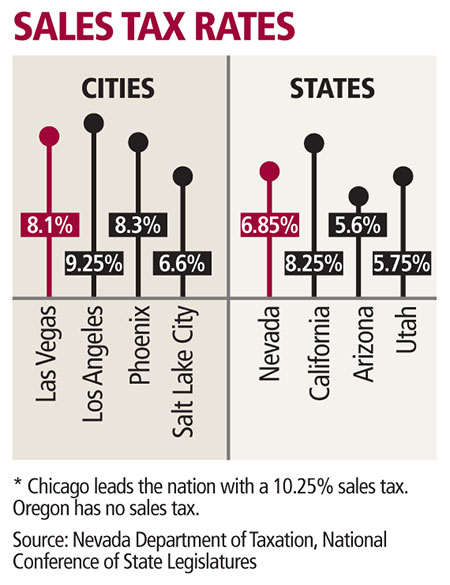

2020 rates included for use while preparing your income tax deduction. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. CLARK COUNTY PROPERTY TAX RATES Fiscal Year 2020-2021.

Nevadas tax system ranks. Clark County collects on average 072 of a propertys assessed fair. 31 rows The latest sales tax rates for cities in Nevada NV state.

Washoe County collects the highest property tax in Nevada levying an average of 188900 064 of. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

Using A Nevada Incomplete Grantor Trust As Part Of A Business Exit Strategy Spencer Fane Llp

How Many People Pay The Estate Tax Tax Policy Center

Nevada Estate Tax Everything You Need To Know Smartasset

Saving State Income Taxes Ning Trusts And Completed Gift Non Grantor Options Ultimate Estate Planner

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Sales Tax Rate Rates Calculator Avalara

Nevada Estate Tax Everything You Need To Know Smartasset

Is Now Any Time To Raise The Property Tax Nevada Current

Taxes About To Increase Las Vegas Review Journal

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Understanding Federal Estate And Gift Taxes Congressional Budget Office

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

State By State Estate And Inheritance Tax Rates Everplans

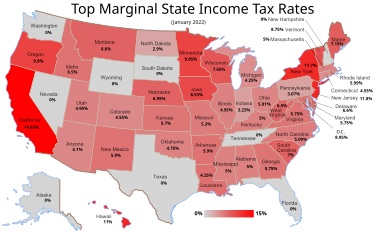

State Individual Income Tax Rates And Brackets Tax Foundation

Historical Nevada Tax Policy Information Ballotpedia

Which Side Of Lake Tahoe Has Higher Property Taxes Mansion Global

.png)

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)